All Categories

Featured

[/image][=video]

[/video]

Withdrawals from the cash value of an IUL are usually tax-free approximately the quantity of costs paid. Any type of withdrawals above this amount might undergo tax obligations depending upon plan framework. Standard 401(k) contributions are made with pre-tax bucks, minimizing gross income in the year of the payment. Roth 401(k) contributions (a plan function readily available in most 401(k) strategies) are made with after-tax payments and afterwards can be accessed (incomes and all) tax-free in retired life.

Withdrawals from a Roth 401(k) are tax-free if the account has actually been open for at the very least 5 years and the individual is over 59. Possessions withdrawn from a standard or Roth 401(k) prior to age 59 might sustain a 10% fine. Not specifically The claims that IULs can be your own bank are an oversimplification and can be misinforming for lots of reasons.

Nonetheless, you may undergo updating associated health and wellness inquiries that can impact your ongoing expenses. With a 401(k), the cash is always your own, including vested company matching regardless of whether you stop contributing. Risk and Guarantees: Firstly, IUL policies, and the cash value, are not FDIC insured like conventional savings account.

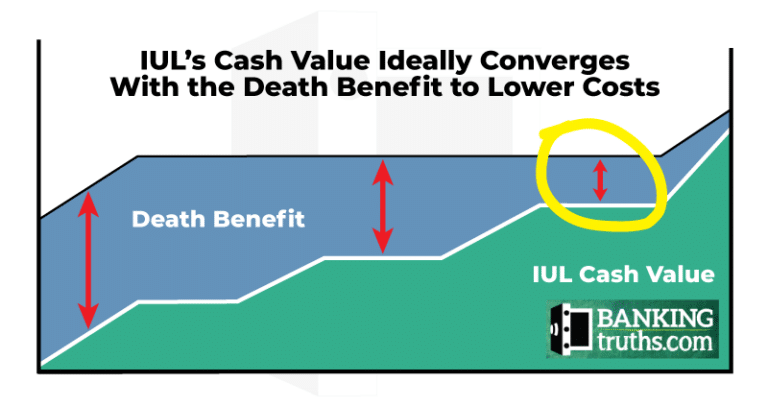

While there is generally a floor to stop losses, the development potential is capped (implying you might not fully take advantage of market increases). Most experts will certainly concur that these are not similar items. If you want death benefits for your survivor and are worried your retirement financial savings will not suffice, then you may intend to think about an IUL or various other life insurance product.

Sure, the IUL can provide access to a money account, yet again this is not the key function of the product. Whether you want or need an IUL is a highly individual concern and relies on your primary economic goal and goals. However, below we will certainly try to cover benefits and limitations for an IUL and a 401(k), so you can additionally define these products and make a much more informed choice relating to the ideal means to handle retirement and dealing with your enjoyed ones after death.

How Does Index Universal Life Insurance Work

Loan Costs: Fundings versus the policy accrue passion and, if not paid off, reduce the survivor benefit that is paid to the recipient. Market Involvement Limitations: For a lot of policies, financial investment growth is linked to a stock market index, but gains are normally covered, restricting upside possible - iul life insurance reviews. Sales Practices: These policies are typically marketed by insurance policy representatives who may stress benefits without completely describing prices and dangers

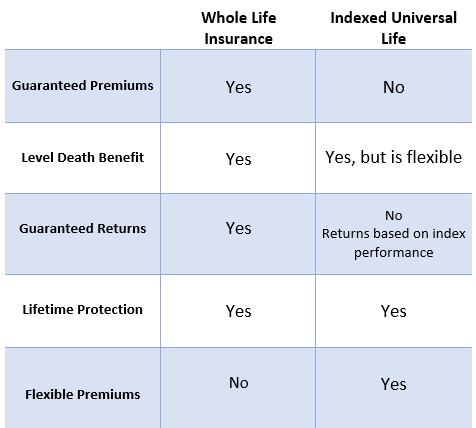

While some social networks pundits recommend an IUL is a substitute item for a 401(k), it is not. These are different items with various objectives, features, and costs. Indexed Universal Life (IUL) is a sort of irreversible life insurance policy plan that also supplies a cash money worth part. The money value can be made use of for numerous purposes including retired life cost savings, extra revenue, and various other economic needs.

Latest Posts

Pros And Cons Of Indexed Universal Life Insurance

Single Premium Indexed Universal Life

Indexed Variable Universal Life